Insurance 2.0.

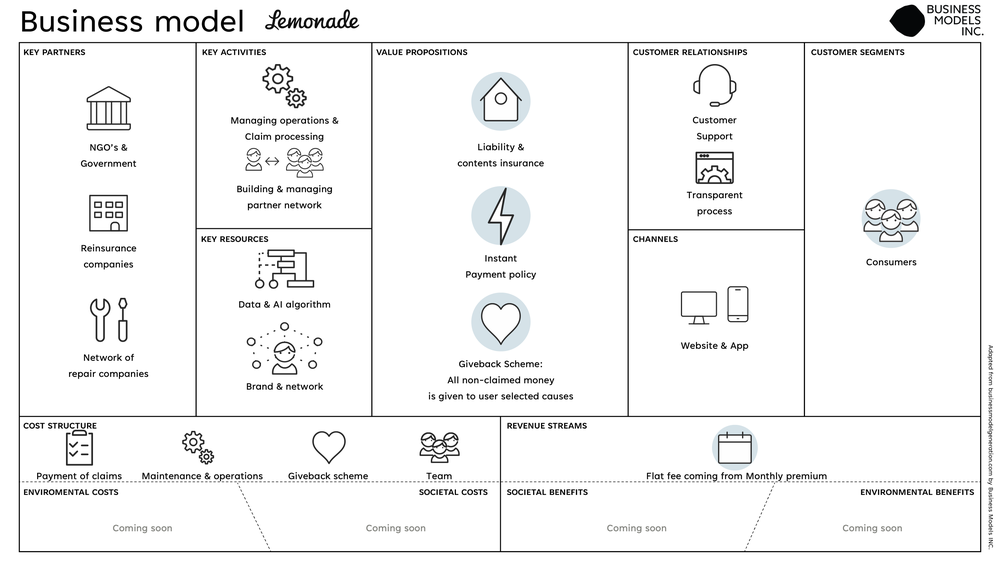

“Forget everything you know about insurance”, is the slogan visitors of Lemonade’s website are greeted with. USA based tech company Lemonade, founded in 2015, entered the market to change the game. Their big vision is to take insurance from a “necessary evil and change it into a social good”. Therefore, they have been building a service that fits seamlessly into the 21st century. Not only in terms of technology, but also in terms of putting people over profit, because Lemonade solves customer needs but also takes into account society as a whole.

First of all, they threw all the traditional paperwork out of the window. Do you want to submit a claim? Just open up your device and submit it straight away. All of their services, currently consisting of contents and liability insurance, are available from any laptop or smart phone. A simple and easy to follow process takes you through to your very own insurance policy. Every part of your relationship with Lemonade is managed through their online portal.

Second, Lemonade managed to speed up the claim process from weeks to mere seconds because of their artificial intelligence. About 30% of the claims can be paid “immediately” once they are checked by their anti-fraud algorithms. More difficult claims are handled by a team of real and service-minded people.

The real game changer, however, is the fact that Lemonade treats premiums as the customer’s money and not as their own. Customers still pay a premium per month, but the big difference is that Lemonade donates all unclaimed premium income to customer-selected charities at the end of each year. By taking just enough to cover overhead and salaries, their core business is not making profit, it is making a difference for all the stakeholders they serve. Last year they donated over 500,000 USD to different charities. This simple concept has created an enormous amount of trust between customers and insurance providers.

Lemonade is building a strong transparent relationship with their customers while also contributing to lasting positive social change. As a certifiedB-corp, Lemonade is showing the insurance industry that genuinely taking care of all the stakeholders affected by your business is simply how you are going to remain relevant in the future.